Trust and optimism used to rise and fall with the political tides. Not anymore. Both it seems have washed out to see.

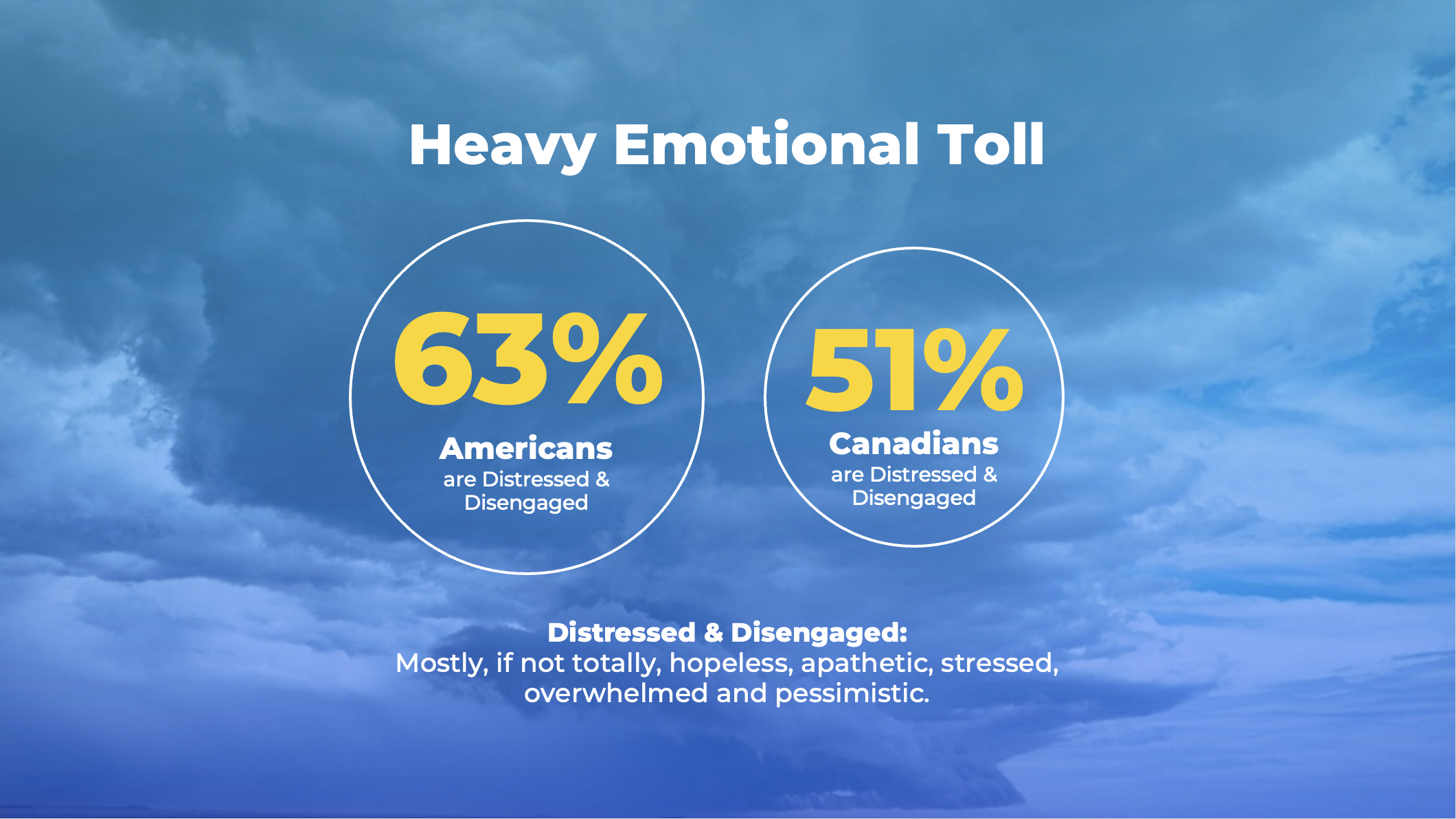

Our latest research reveals that a strong majority of Canadians and Americans no longer have confidence in their system of government. Nearly half of Americans report feeling hopeless. Anger and frustration across North America are at historic highs.

This is more than a rough patch. It’s a crisis of confidence with serious consequences for democracy, the economy, and the brands that operate within them.

In our recent webinar, Brands in Uncertain Times: The Citizen Consumer Project, Shelley Brown, Chief Strategy Officer at FCB Canada, and Jennifer Birch, Head of Public Affairs at the Angus Reid Group, presented a sweeping new study on the emotional volatility reshaping both political and consumer behavior.

While it’s contrite to say “it’s no longer business as usual,” it truly isn’t. Toplines, averages, assumptions and tried and true strategies are riddled with challenges. Does the current climate require a wholesale revision of your strategy? To be fair, no. However, it does require are more refined approach and a far closer look at the story behind the data you rely on to make choices. As Shelley points out… “beware the average” because in this day and age, it’s calculated from extremes. Which brings me to my first of four key takeaways.

Three Key Moments from the Webinar

1. Beware the Average

One of the sharpest warnings from the webinar: averages hide the real story. Relying on topline numbers around sentiment or spending can mask the reality of how different segments are coping.

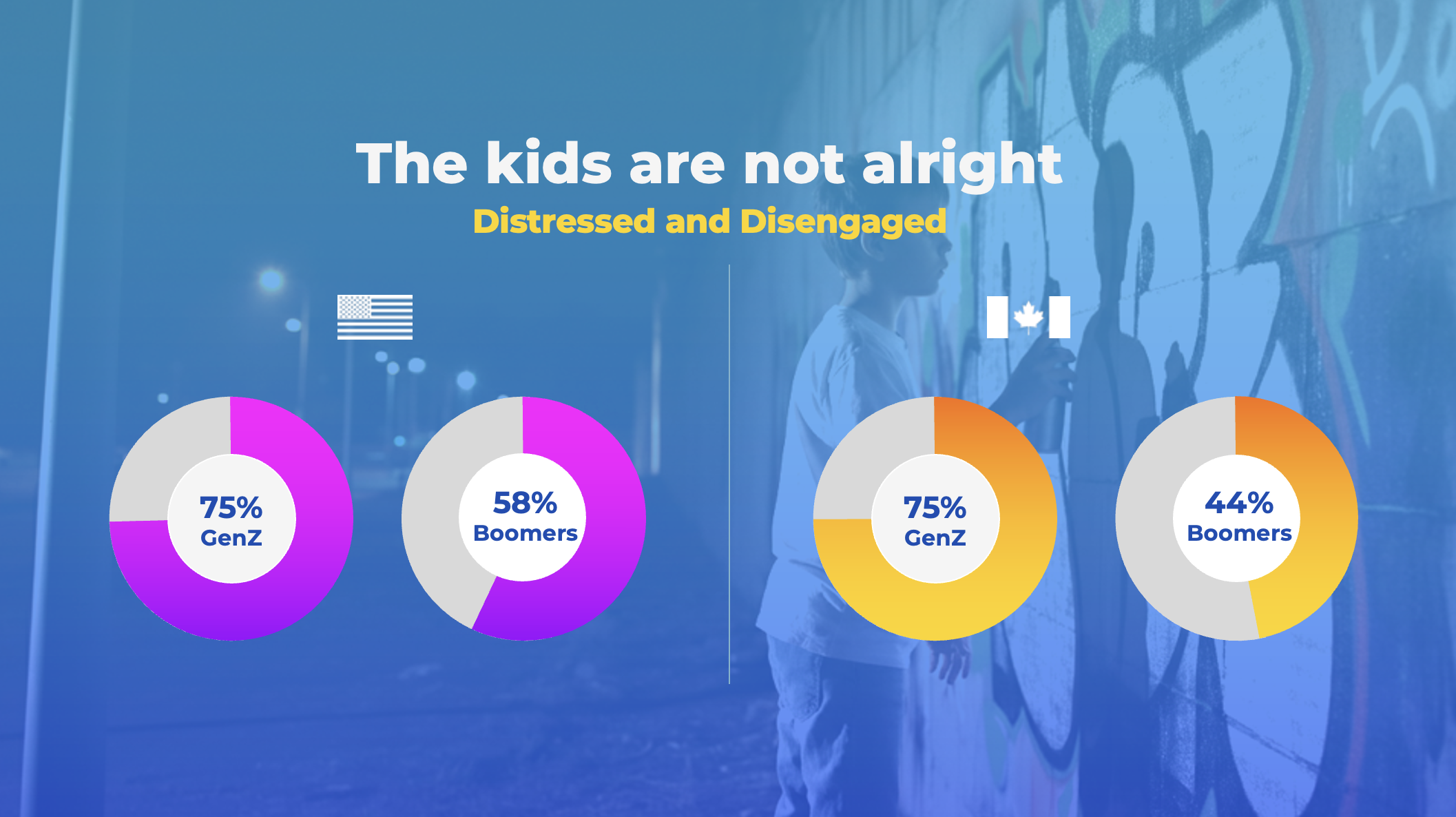

“Behind the average, entire generational and political dynamics are playing out,” said Shelley. “Gen Z may be quietly disappearing from your data if you’re not looking closely.”

This is a call to segment more intelligently. Brands must understand not just who people are demographically, but how they are feeling and what they are experiencing emotionally and politically.

2. The Kids Are Not Alright

Gen Z is feeling the strain more than anyone. Three-quarters of them fall into what we call the “distressed and disengaged” segment. These young adults are not just financially insecure; they are emotionally overwhelmed and unsure about the future.

“They’re not just financially constrained—they’re emotionally tapped out,” said Shelley Brown. “Brands need to meet them in their space, on their terms, with something real.”

Connecting with this generation means more than showing up in the right channels. It means understanding the depth of their disengagement and responding with relevance and care.

3. Maple Washing Doesn’t Work

Putting a maple leaf on your packaging or talking about community involvement isn’t enough. Canadians are looking for proof of authentic connection. They define a Canadian brand based on where its products are made and sourced – ingredients, materials, packaging or otherwise – not marketing cues.

“You need to know where you’re coming from and what your audience already believes about you,” said Jennifer Birch. “You need to be authentic and honest.”

This insight applies across borders. In both Canada and the U.S., authenticity matters more than symbolism. Brands that try to posture without substance risk losing trust fast.

Must-See Highlights

If you watch the recording, here more insights worth listening for:

• The Tariff Effect

More than half of North Americans say tariffs are making it harder to afford essentials. Many are now cutting back on groceries and even health care.

• The Partisan Economy

Eighty-three percent of Republicans in the U.S. report feeling hopeful, compared to just 13 percent of Democrats. These divides are reshaping not only political attitudes but consumer choices too.

• The Heinz Example

Heinz is still an American brand, but its Ontario-sourced tomatoes matter to Canadian consumers. It’s a good example of how to acknowledge your roots while building local relevance.

• Consumerism as Protest

With trust in institutions declining, people are expressing their values through the brands they support. Buying Canadian or American is becoming a way to push back against systems they feel powerless to change.

What Comes Next

Understanding your audience now requires more than knowing their age or income bracket. It means understanding how they feel, what they believe, and how they see the world. The most successful brands in 2025 will not be the cheapest or the loudest. They’ll be the most in tune.

Watch the full webinar on demand here:

Or feel free to reach out to me directly and I’ll send you a copy of the deck and connect you to Jennifer Birch, our EVP of Public Affairs.

See the full transcript from the webinar below:

Brands in Uncertain Times The Citizen Consumer

Ben Hudson 0:06

Hi folks and all the people that are in the waiting room waiting for us to get going.

It’s just 11:00.

Now we’re at top of the hour, 2:00 in Back East.

I will give everybody a minute or two to join, so just hang with us and we’ll get started in about 60 seconds.

OK, people are joining pretty fast now.

Seems everybody’s probably grabbing their coffees and taking a seat. So let’s say let’s start in in 60 seconds because we’re up to almost 100 people now.

So people are piling in.

OK.

You ready to go?

Let’s do this.

Thanks for joining everybody to our live webinar brands in uncertain times. The Citizen consumer project.

Once Upon a time, there was a pretty clean distinction between the role of citizen and the role of consumer.

People voted at the ballot box and they voted again at checkout.

But those rules have collided.

And today, purchasing more than ever has become a political statement.

People are choosing.

Sorry one SEC. People are choosing where to spend.

Not based, not just on price, but on the quality and on the values and the beliefs and frustration with the systems around them, the frustrations and what they see. They’re expressing those frustrations in the way that they spend their money and I am here to tell you that.

That frustration is growing in a significant way.

The latest research that we’ve done in partnership with FCB shows a significant decline in trust and optimism across North America.

And the majority of Americans and Canadians say they no longer have confidence in the system of government.

That we’re in today and even half of those people again say that they are feeling hopelessness. Anger and disillusionment are at what we would say are historic highs.

And this isn’t just a passing storm.

It is what we would consider a shift with serious implications for democracy, for the economy and for brands, and for perhaps a lot of the people that are watching this webinar today and anybody who is trying to build a new relationship with an audience and in this web.

We’re going to go and dig into some of the key insights that’s uncovered in the research project that we have called.

The Citizen consumer project.

This project was delivered by FCB in partnership with the Angus Reid Group and I’m very pleased to be joined by two people who have their finger on the pulse of popular culture and politics across North America.

One of those people is Shelley Brown, chief strategy officer at FCB. I’m not gonna pretend I’m not writing her bio. It is.

It’s quite impressive, so I am just gonna read it.

Shelley joined FCB in 2015 and under her leadership.

She has become an absolute.

She has helped that agents become an absolute.

Strategic powerhouse, they were named Global Strategic Agency of the Year in 2022 at the Cons International Festival of Creativity.

She was a juror on the strategic.

Plan at this right?

But I believe she was the head juror or the lead juror at the cons in 2024. She has crafted messages for all some of the biggest brands you can imagine.

Brown, Shelley (TOR-FCB) 3:59

Sure.

No.

Ben Hudson 4:07

Unilever, Molson Coors, BMO, you name it. Shelley’s touchstip and joining Shelley is our very own EVP of Public Affairs, Jennifer Birch.

Jennifer Birch is one of the most experienced people in public.

Affairs and market research in Canada.

Her experience is global.

She has guided multinationals, banks. She has guided airlines. She has basically worked with everybody and anybody who is shaping economic policy.

And she has improved service delivery for many, many departments, including the Government of Canada. So with no more from me, I am going to pass it to our friends Jennifer Birch.

And she is going to take us into some of the research they have done. I’ve been looking forward to this.

I hope you guys have as well.

Jennifer Birch 4:50

Thank you.

I have to say this citizen consumer project has been a lot of fun, really eye opening, but maybe one of my favorite things is getting to know the folks over at FCB.

We’ve done a we’ve had a lot of laughs and a lot of late night with the gang, especially Shelley, who’s contributed, you know, a lot to the discussion around this.

So really excited to be in partnership with FCB and excited to tell you a little bit more, but enough, blah blah blah.

Let’s dive in.

That’s not what you’re here for.

You’re here for the the data.

Yeah. So I won’t go up, you know, on and on about this.

We can.

We’ll send you guys, you know, some information.

This all be recorded and shared, so I won’t get into the like.

How many sample sizes, etcetera, etcetera. But we spoke to a lot of Canadians and Americans.

We’ve been tracking this issue since it sort of poked its head out since January, which is actually when we launched our public affairs practice here at Angus Reid.

So we’ve been tracking this for some time we’ve done.

Canada, we’ve done the US and we’ve also done some small and medium sized business samples.

In Canada, as well as decision makers in large enterprise, so have quite a wealth of data on how things have evolved in the last little while and in conversation with our friends at FCB, really saw that intersection between what does that mean not just for understanding the public.

Affairs sphere and how we can help not for profits, government agencies etc. And and large organizations in terms of their government relations.

But what does it mean for how organizations communicate and engage with?

Citizens, consumers.

Right. That is no longer a distinctive that that’s no longer 2 distinctive roles.

Right. It’s people are people and they believe what they believe and it affects all of the things they do and all of their behaviors.

So we launched this study together.

We talked a whole boatload of people, 39, three, 1950 people, a little bit more in Canada than the US, but blah, blah blah. We can deal with the details later.

So one of the first big issues we talked to both Canadians and Americans about was tariffs.

So we asked, you know, is it on your mind?

Are you concerned about it?

Etc etc etc etc.

And what we learned is that it really is weighing on the minds of both Americans and Canadians.

Not surprisingly, it’s a bigger issue among Canadians.

We’ve got 84% of Canadians saying that they’re worried about the impact impact of tariffs on the Canadian economy, but equally or not equally. But in comparison, we have 66% of Americans who are worried about the impact of tariffs on the American economy.

So people are paying attention.

They’re concerned this is an important issue.

In in addition to that macro level perspective about concern about the economy in the future, we talked to people about what’s the impact on you personally.

So we have over 50% in both countries who say that tariffs are making it harder to pay for groceries, plan for their retirement, save money.

So this is having a pretty significant impact on people individually as well as a sort of esoteric kind of like national issue.

This is actually quite personal for people.

And it’s a it’s affecting their daily lives.

Perhaps the most poignant question is always OK.

You’re worried about what’s happening to the country and the economy. You’re kind of worried about your spending and what you can afford at the end of the day, what most of us are worried about is what’s my job security?

But what?

How am I going to be able to continue to live and make money and and and pay for all of these things? So this is, you know, kind of a down number, but one in two Canadians and Americans are actually worried about their job security.

So we have more detail on that and like I said, we only have 30 minutes, but if anyone’s interested, let us know.

We do know that 6% in Canada have already lost or expect to lose their job, and that 48% are concerned about the safety of their jobs. So in Canada and then we have the US numbers, we have more, but I think the the main thing.

Is half of North American residents working residence?

Are quite concerned that this tariff situation is going to impact their job security.

And that’s a real concern.

So we talked about tariffs.

Everyone’s concerned.

But it’s not the top issue and it hasn’t been.

It’s been near the top.

It’s kind of fluctuated a little bit, but our latest sounding as part of this project we’ve done together is that in the US, tariffs are the number six top issue for Americans. And it’s the number three top issue for Canadians.

What is the biggest issue for everybody?

Cost of living and of course you know.

I always see these and I’ve done them in my life.

Now, 20 years in the public affairs space and public opinion research, you have to do up top issues ranking. But the fact of the matter is, all of these things are intertwined.

So your concern about the cost of living is not separate from your concern about tariffs. But nonetheless, when we kind of forced the trade off and we want to understand what the big issue is at the end of the day, what’s driving it is a concern over the.

Cost of living. It’s rising.

Wages are not inflation’s all over the map.

The market’s all over the place.

There’s a lot of uncertainty, and so, not surprisingly, people are really refocused on the cost of living and whether or not they’re going to be able to survive under the circumstances or thrive depending on which echelon of society you’re part of.

Still, this slide changed a little bit since I saw it last.

There’s a little graph behind.

It’s very nice. Thank you.

OK.

So the concern about about the cost of living, what’s driving that?

So we’ve got a couple of different issues we wanted to touch on here.

9 and 10 are concerned about the rising cost of everyday items.

So the stuff you’re buying every day, whether it be gas or groceries or the sort of everyday stuff 9 and 10 in both countries, are concerned about the affordability of absolutely everything.

Or sorry, the rising cost, I should say, of absolutely everything.

Major expenses, we’ve got 8 and 10 concerned about those major expenses.

So that might be a car that might be buying a your dishwasher breaks or whatever major might mean within the different echelons.

And of course, we’ve got all that data on whether it’s income level or whatever that we’re happy to chat with you about. But these are, this is what surface stuff in the analysis and then seven and 10 are concerned about saving and investing.

So the first two are very important now, but the saving and investing number is pretty pretty high and pretty concerning as we look at the future because we’ve got an aging population, we’ve got a lot of demographic changes happening and there’s concern was I suppose to get that.

To you, Shelley. Sorry.

Brown, Shelley (TOR-FCB) 11:25

No, it’s all good. All good.

Jennifer Birch 11:27

They did it anyway.

But that that really freaks me out a little bit to be honest.

The saving investment number, and it’s not unheard of. I mean, people are always concerned about saving and investing, but when you put it in the context of everything else.

Else we’ve talked about, I think this is really a true read on on how people are feeling. So over to Shelley.

Sorry to carry on.

Brown, Shelley (TOR-FCB) 11:46

It’s all good and the the end result of all of this angst and concern about affordability is people are cutting back and they’re cutting back on what they’re spending now.

But they expected that to continue.

So we’ve got about half of Americans and Canadians saying they’re cutting back on what they’re spending now, but even more of them, 53% in the US and 63% in Canada, say, Oh yeah, I’m going to that’s going to keep going.

So they expect the tough times.

Times to continue.

And yeah, as again, it’s pretty natural, right?

You start by cutting out the discretionary spending.

You cut out the fluff.

Restaurants, entertainment, travel.

But what’s happening now is that at least 30% of Americans and Canadians are cutting back on essentials, too.

They’re cutting back on things like groceries and in the US, 20% are even cutting back on health and medical expenses.

So the implications for brands?

At this point are, yeah, value is paramount paramount for North Americans right now.

But brands have to think about ways to deliver value, both rationally and emotionally.

Now, there’s no question price and value will be relevant and absolutely compelling in the short term. And in fact in the foreseeable future.

But the emotional connection is also going to matter because we know that the only and really the best long term protection for a brand against price sensitivity is building that strong emotional connection between your target audience and your brand.

So you have to be really careful about pushing consumers to interpret things purely rationally.

Because they will start price comparing and I’ll pick the cheapest if the only thing you talk about is price.

So if you’ve got the lowest price in the category, believe for you, sing it from the rooftops. You’re good.

But if there’s a chance that you don’t.

Make sure that you’re building brand love because it will be important.

And it’s going to be important because all of this is taking a really heavy emotional toll on people. 63% of Americans and 51% of Canadians are what we are calling distressed and disengaged.

And what that means is that they right now feel mostly, if not totally hopeless, apathetic, stressed, overwhelmed and pessimistic.

They are.

Jennifer Birch 14:24

And Shelley Shelley, if I can jump in real quick for any research geeks out there, we did a segmentation right and we kind of looked at. And so these groups came out and distressed and disengaged. Is is what Shelley’s talking about. But it is driven by SE.

Brown, Shelley (TOR-FCB) 14:26

Yep.

Jennifer Birch 14:37

As opposed to sort of a, you know, a review and and pick and choose kind of this is driven by segmentation which again if you want to talk to us about call us.

It’s too long to go through on this webinar, but carry on Shelley, thank you.

Brown, Shelley (TOR-FCB) 14:49

Yeah, absolutely.

So the point is.

That this disengagement, the issue with it, is that it is really toxic. People who are feeling this way, they’re feeling more negative about just about everything.

So among the majorities who are distressed and disengaged, they are much more likely to believe that democracy is under threat.

So there’s that kind of high level concern of the citizen, but it’s also affecting.

How they behave as consumers as well.

Two and three of the distressed and disengaged expect to cut back on their spending. And So what we’ve got here is as a target audience, this is a very challenging group for brands to connect with, but we have to keep in mind they are right now the major.

So implications for brands?

Here again are you’ve got to find ways to really tap into and help.

Them take control of what they can in their lives and we can see this playing out.

People are.

They’re moving to discount brands and retailers.

They’re choosing private label.

They’re looking for offers and promotions and they’re trying to squeeze as much as they possibly can out of their loyalty programs. So that, yeah, they want to take control, but they are hurting.

They are feeling down, so they need empathy too.

You can draw all kinds of parallels to the early days of COVID.

But they will reward brands that show that you get it and brands can provide reassurance. But they can also provide optimism and a badly needed laugh or two.

Don’t discount the importance of humor in helping people get through and giving them a connection point with brands.

It is no coincidence that the most popular spots on YouTube right now are all the funny ones.

Jen, you’re on mute.

Jennifer Birch 16:53

Sorry, I think it’s back over to me, OK.

So from what we’ve learned so far, it may not be surprising to everyone that our thesis proved some quite, quite true actually.

Which was that? Citizens and consumers don’t behave separately.

A person doesn’t divide themselves between soccer mom, consumer, voter, etc.

People are humans and the decisions they make are very, very intertwined.

But we thought this question was really quite compelling.

Both Americans and Canadians are have sort of split identities when it comes to where they have the most power about the future of their society.

So when we ask these questions, we found out that Americans are basically completely divided in terms of whether they have more power as a citizen over the country or more power as a consumer.

And when we talk to Canadians, it’s actually lower in terms of citizen and more in terms of consumer.

So it’s an interesting question.

Because I think we would have seen the numbers be quite different.

Spent some time ago, so this is where we’re well. How do I press the button? Here we go.

So when we talk about what they’re concerned about and why those citizen and consumer concerns are coming together, we looked at three of the questions we asked that kind of demonstrate this, I think.

And I think Shelley might have met the top sort of touched on this earlier, but we have 72% of Americans who would say that democracy is under threat.

Or maybe actually it was Ben.

Doesn’t matter.

72% of Americans say that democracy is under threat today.

And 67% of Canadians.

So there’s real concern about not just the government empower the political leaders that are out there. It’s a better system of government.

There’s a lot of concern about whether or not you know the system of government is is still sort of adapted to today’s society.

So there’s concern over whether democracy is still working and whether or not it’s under threat.

Then we have 3/4 in both countries that say that they’re concerned about the direction of the country.

So those are some pretty high numbers. And then you look at whether or not they feel they’re in control of their finances. Well, a majority of both countries, majority in in the States and half of Canadians say that their finances are actually out of their control at this.

Point. I mean, things are just happening and it’s going to happen the way it happens and if there’s nothing I can do about it.

So there’s a bit of an apathy there, and then all this concern about where things are going and concern about our system of government.

So it’s not surprising to see.

That this is where people are at at this point.

So politics do matter, and this is kind of the beauty of of the FCB and and Angus Reid public affairs getting together is that politics matter in our world all the time.

But they actually matter in advertising and they matter in communications, and they matter in, in marketing and all of that.

So here’s a little bit of evidence.

Excuse me.

So we asked, are you feeling hopeful?

Are you feeling distressed?

Are you?

You know all these emotional questions.

And in the US, we had 42% saying they’re feeling hopeful.

Well, what do you do with that number, right?

Like, I mean that’s maybe higher than I would have expected, but it’s still like what do you do with that, right?

So how do we dig into it?

Well, what was most compelling when we looked at how?

What made-up that number?

Is that those who felt hopeful?

13% were Democrats and 83% were Republican.

So there are some strong political lines that are driving how people are feeling and as we start to think about how we’re sort of imbibing this data and the information that we collect and how we’re using it towards whether it be political, not-for-profit or private se.

These these lines are increasingly.

Contrasting and this is a pretty strong evidence. Pretty strong evidence of that.

So to reinforce that, we pulled a quote from The Economist. According to their analysis, which which echos what we’re saying, America’s splitting into two different economies and markets.

One conservative, the other liberal people on each side think about the economy differently.

They buy different things and they work in increasingly different industries. So just a third party, you know, respected, I think third party.

That kind of echoes the kinds of things we’re seeing in our data.

So when it comes to actual behavior, we see that if we look down that political divide again, we’ve got 57% of Democrats are spending less and 29% Republican.

So again, quite a contrast. That’s the word I was looking for earlier.

Quite a contrast between those who vote Democrat versus Republican.

So the the party lines are really having an impact not just on how people vote, but on how they behave and how they’re living and the choices they’re making in daily life.

So we see similar trends in Canada.

Excuse me.

So it’s easy to kind of say, well, we’ve always had the two party system in the US and that’s not surprising, but it’s not.

It’s not an American phenomenon right now, for the first time since the late 50s, I think it was 58. We looked up the Liberals and conservatives effectively split the vote, and public opinion, of course between them.

So there’s very little middle ground. Excuse me.

So we’re seeing the same trends kind of emerge in Canada as well.

So when again we talk about behaviors, 38% of liberals are spending less and 52% conservative.

Quite a stark contrast across both of those.

Who? I went ahead.

Both of those groups. So we are seeing that kind of two party divide and now that we’re understanding how much that kind of political affiliation is driving spending power. It’s important to watch both in both countries.

No matter who you are, quite frankly not-for-profit or private sector or government, it’s really important to be paying attention to that and understanding how to communicate and how to meet their needs. And then I will hand it back to Shelley.

Brown, Shelley (TOR-FCB) 22:49

All right, absolutely.

So in terms of the implications for brands, it really comes down to this.

You have to understand your target audience and to understand people today you have to understand them both as citizens and as consumers.

So that means you got to know their politics.

For a long time, brands have really tried to stay outside of the political fray, OK?

Maybe not Ben and Jerry’s, but most brands.

And it’s really not a viable option anymore. Brands are political.

And so, if you’re gonna know your consumer, you’ve gotta add political affiliation to every tracking study. You have to understand how they view the world as a citizen. You’ve also got to think pretty carefully about the channels that you choose.

Because what channel your brand shows up in sends a message to your target audience.

Are you showing up on Joe Rogan or Michelle Obama’s podcast?

It definitely sends a message.

Brands are now political.

And so are channels.

And we can see this playing out in a couple of different ways.

The Harvard Business Review a couple years ago did a really fascinating analysis of the politics of beer.

So what they did was they mapped beer sales across the US by county. So you could tell which brands sell better in more Democrat counties versus more Republican counties. Now if you think back to some of the controversy that Bud Light went through, if they had known.

If the marketers had known at the time that their brand skewed Republican, would they have made different choices? I don’t know.

But it might have been useful information, and if we think about even what’s going on with target just this week, they’ve had to pull back their forecast of sales, partly because of uncertainty due to tariffs, no question.

But they said also the other thing that’s really hurting them is they’re suffering a real backlash because of their rollback of de and I programs.

Now, if Target had understood how important those programs were to their core audience, if they’d understood their audience as citizens and their political perspective, it might have been helpful information to help them navigate very, very difficult times.

So what we’ve got right now going on is under this kind of stress and pressure.

Sometimes that brings people together, but often what actually happens is it widens.

Social gaps.

It’s the same storm, different boats phenomenon that we’ve seen playing out in the political sphere, but it’s playing out in other ways too.

And the one thing to keep in mind is that right now the generation gap is widening. And Simply put, the kids are not alright.

We’re now in a situation where 75% of Gen. Z.

Are feeling distressed and disengaged, so they fall into that same segment and it’s a segment that’s full of negativity.

About the health of democracy, about whether or not they feel proud of their country, whether or not they feel that they will ever be able to afford the kind of future they want, 75% of them are feeling really down.

The kids are not alright and it’s having an impact not only on them as citizens but also as consumers.

So if we think about this in terms of brands and the implication for brands, you’ve got to watch out for those averages.

You look at an average and an entire generation and its concerns can be hiding underneath those numbers.

Brands really need to understand how is genzed responding to my brand. You got to think about it also in terms of the channels that you choose, if you’re only in mainstream channels, chances are jenzed doesn’t encounter your brand ever.

So develop specific strategies for young adults and keep in mind that they are not only.

Constrained financially.

Their prospects are also constrained. Their view of the future and just the emotional resources that they can bring to bear. So tap into their interests and their passions.

Where are they?

What are they doing?

Show up in their spaces on their terms and earn your right to be there.

Jen, you’re on mute.

Jennifer Birch 27:16

My apologies, I took control effectively but did not unmute.

So in all of that context, where are we on Northern pride?

So we’ve all probably been hit over the head with the fact that Canadian pride is through the roof and it’s been increasing since all of this started and all of that. So it won’t be surprising to see that 70% of Canadians are feeling more proud of their.

Country or feeling proud of their country and that’s compared to 45% among Americans.

And and I when I first saw some of our tracking numbers, I went, wow, I would have expected Americans to be more proud of of the US than Canadians of Canada. But in fact, over the years, that’s not actually totally been the case.

But we have seen a real spike.

So it is as much as it doesn’t completely buck a trend. They spike, and the increase that we’ve seen has been quite impressive.

So a lot of national pride in both countries.

But in Canada, it’s tinged with a little bit of anger.

And for anyone who’s studied society and studied.

Canadian identity we do tend to identify in ourselves in opposition to the US. You know, it’s that elusive Canadian identity.

Is it poutine?

Is it Tim horton’s?

Is it the Beaver?

Is it this?

It’s not as deep rooted right where Americans are very much identified with the seat of the presidency, you know, and and all of these other things.

So all that to say, not entirely surprising, but the anger is quite cute.

So if we if we look at the numbers, 66% of Americans.

Americans are angry right now.

But 76% of Canadians are, and when we talk to them about this by Canadian movement, we ask them Canadians, we ask them, you know, what’s driving you to to buy Canadian.

31% say they’re sending a message to the US government and 72% are really focused on boycotting American products.

So it’s less about buying Canadian as it is this sort of oppositional kind of angst against the United States, so.

That’s an interesting kind of thing.

That’s evolving there.

How long it will last? We’ll see.

And this might start to tell us, you know, how long it will last as we continue to watch watch these numbers.

So 43% of Americans are buying American, but 71% of them say it depends on price and quality. Like I feel very strongly about this. But at the same time, you know well, if it’s too expensive and if it’s kind of crappy, then I’ll buy.

Whatever, I just want good.

I want a good price and I want good quality products.

But I’m going to make an effort right to buy American.

And then 28% are buying domestic no matter what, which is still pretty strong number. I don’t think we would have seen that you know a couple years ago, but who knows, 83% of Canadians say they’re buying Canadian, which is a big strong number and.

That doesn’t mean that they’re exclusively buying Canadian.

That means they’re trying to, but when we talk about all those who’ve shown interest in and a commitment to buying Canadian depends on price and quality and by domestic, no matter what is split.

But so we see like a stronger like a stronger foothold, I would say in terms of this by Canadian movement in Canada in terms of maybe lasting longer in the sense that half are concerned about price and and quality, but almost as many are gonna do it, no.

Matter what?

And of course that.

And we all know that’s gonna play out if the economy really tanks. If we end up in a recession, as we’ve been saying, we’re on the precipice of for six years now.

But when you know if, if things really changed dramatically, I think those numbers will flip quite dramatically as well.

So we have to keep our eye on the prize.

But those are some pretty strong sentiments in the current situation, which I think are important to consider. That dichotomy between how the Americans are doing their binational movement versus how Canada’s approaching it, or Canadians are approaching it.

So if that’s important, if by Canadians important, what does it mean to be a Canadian brand, and what does it mean to be an American brand?

So we can all come up with our ideas, but we ask Canadians, how do you evaluate whether a brand is American? And among Americans, the number one issue was, are they headquartered in America, followed by they produce and source what what they make from US suppliers and in.

3rd place that they employ a lot of Americans.

So those are kind of the the hallmarks of a Canadian or sorry, an American brand and the according to us.

Consumers or us participants in the survey.

When we look at Canadians, it’s a little bit different.

Canadians are more concerned that a brand produces and sources from Canadian suppliers, so that’s really the hallmark of a Canadian brand.

Is that what they’re selling?

What they’re delivering is actually coming from Canadian soil, headquartered in Canada.

Less important, but still #2 and majority Canadian owned is in 3rd place.

When we look at the bottom tier and you know there were, there were other options here. And again, anyone who wants to talk about this.

We have so much data.

Love to talk to you about it.

We could talk for hours.

It’s unbelievable how much data we collected, but we had to squeeze in what we had here. If you look at the bottom two, you see the same across both countries used as American symbols versus Canadian symbols involved in US community causes. Canada Canada community causes, so we wanted.

To highlight this here, because and and this is something Shelley will talk about, I think in the, in the recommendations or maybe I will.

But Maple washing.

So the fact that you’re putting an American flag or a Beaver or a Maple Leaf on something is not compelling to folks, generally speaking.

And then touting sort of your engagement or involvement in the Community, well, important for different reasons, is not sending the message that it’s a Canadian company, right?

People, I think, have gotten on to.

We’ve gone from, like greenwashing and social and all this other stuff to now it’s an expectation.

You should be investing in the communities you’re in.

But it doesn’t make you a Canadian company or an American company.

It’s just something you should be doing regardless, as human beings, right?

So if you really want to look at how you want to elevate yourself as a Canadian or American brand, you want to focus on the top half and not sort of reduce yourself to the symbolism and the kind of Maple washing which Shelley came up with, which I.

Thought was a great way of putting it.

Brown, Shelley (TOR-FCB) 33:34

Absolutely. So in terms of implications for brands, obviously it’s a pretty complicated space actually and it really is a continuum.

Jennifer Birch 33:36

Oh.

Brown, Shelley (TOR-FCB) 33:43

So for, you know, a Canadian brand on Canadian soil selling to Canadian, sure wave the flag have at or loud and proud.

It is relevant right now.

They care.

They care pretty intensely, but make sure that you talk about the issues.

As just mentioned, that are really important to them and watch out for the Maple washing.

Now for American brands in Canada or in fact imported brands into United States, keep in mind, even among those who are trying to buy Canadian or buy American, they are still absolutely concerned about value.

Value matters to people right now, and they are saying, yeah, I’m trying to buy Canadian or buy American, but I still care about price and quality. So sell a good product for a good price from a brand that people care about.

That will always be a compelling.

Offer one note though, for American brands in the US that are thinking about tapping into patriotism, the political divides in the US are so polarizing right now that even patriotism itself is political. 20% of Democrats are proud of America right now, 85.

Percent of Republicans are proud, so a little bit of caution before you start, you know, waving the stars and stripes.

But of course, for most brands, most brands are actually somewhere in the middle. Supply chains are really integrated across North America and in fact globally.

So the whole notion of exactly where is this brand from can be pretty complicated now. Right now heights for example, is on television in Canada telling us that they are sourcing tomatoes from Ontario and and that’s great.

It’s awesome, but it doesn’t make Heinz a Canadian brand.

Heinz is an iconic American brand.

And that’s one of the things that people love about it, in fact.

But nonetheless, what they are saying is, listen, we source from Canada, we employ lots of Canadians.

Those are relevant points to make, and that’s a story that’s worthy of being told.

So we’re just gonna wrap up with a few takeaways.

Jennifer Birch 35:56

Alrighty, so engage the disengaged. We’ve talked about our segmentation and the different groups that we’re looking at, but brands must absolutely find ways to engage those people who are distressed and disengaged.

We saw during COVID maybe people went a little too far. At a certain point where every ad looked the same because we’re all hugging each other and saying I’m with you and I’ve got you.

You know, so we have to use some judgment there, but engage the disengaged. Who are the majority right now.

As you know, they’re, as we’ve talked about and you probably already knew, they’re worried about affordability.

And they’re looking for value.

So you want to help them gain control and feel a sense of control and you want to connect with them emotionally. As Shelley mentioned, the value or the power of a laugh. You know, the power of that human connection is incredibly important right now. And then we’ve talked.

About it quite a bit, but avoid Maple washing.

Be careful with the stars and stripes.

Be careful with the Beavers and the Maple leaves. All the things.

And also you know a kind of.

We’re gonna talk about this or Shelley’s gonna talk about this in more detail, but I think on the Maple washing thing, the other thing that’s important. And the example Shelley brought up was Heinz.

So for Heinz has a long standing reputation as not a Canadian company, even though everything’s grown here, which we saw is important to Canadians, the top thing that helps a Canadian identify if it’s a Canadian company, you also have to know where you’re coming from, you have.

To know your legacy and you have to, you have to know how you’re perceived and what you’ve been saying for 50 years. If you’re a younger company.

Me. Right then you have decisions to make, but you can’t.

It’s it becomes disingenuous if all of a sudden, you know, Heinz or you know, company like that suddenly says, well, we’d like to highlight that the tomatoes are coming from Canada.

So it’s also a really complex issue and not to not to push research on everybody, but know your audience and your audience is different in relation to who you are and what you have stood for. And that does matter.

It’s not a simple this is the. This is the trend today. So we’re gonna jump on it.

You have to understand where you’re coming from.

And how that’s going to fit into both their consumer and citizen perspective of how they view you?

So I’ll stop rambling now and hand it over to Shelley, but I think that’s an important thing.

Brown, Shelley (TOR-FCB) 38:02

OK.

Jennifer Birch 38:04

It’s more complicated than it than it might seem, you know.

Brown, Shelley (TOR-FCB) 38:07

Absolutely. The other thing just about knowing your audience is you got to make sure you know your their politics.

Really important to understand that your brand is political.

It does have a political affiliation now, and if you don’t know what that is.

It’s time to find out.

You have to address your target audience both as citizens and as consumers today.

Mind the generation gap.

We all need to pay very careful attention to how Gen.

Zed and even younger cohorts are doing and how they’re responding because they are challenged in just about every way.

And lastly, stay tuned.

This situation is extremely volatile.

It is changing all the time.

You know, a biannual brand tracking study is probably not going to give you the information that you need to navigate what’s going on.

It’s really important for brands to stay connected to their target audience and what’s happening in their lives.

And with that, I think we can go to a couple of questions and you know the last 6 minutes.

Jennifer Birch 39:10

Hmm.

Ben Hudson 39:14

Yeah, absolutely.

We’ve got lots of people hanging hanging with us.

We’re we’re a few minutes over over time, but obviously this is this is this is resonating.

I’ve got a couple questions here that have that have come in, so I will start off. And Shelley, I’m gonna read the question. They you talk about the importance of knowing your customer is understanding the politics of your customer. Another dimension of knowing that customer.

Brown, Shelley (TOR-FCB) 39:39

Absolutely.

Ben Hudson 39:39

And if yes, should brands really be embracing partisanship?

Or using it to navigate the market.

Brown, Shelley (TOR-FCB) 39:46

Right. So some of this comes down to your own values as a brand.

Like what is your how?

What is your brand’s political stance? I mentioned Ben and Jerry’s before and they’re an easy example to take Ben and Jerry’s.

They know where their politics sit. As a brand, they’re very clear about that and they make no secret of it.

That is not the right approach for all brands. And the bigger the brands, the more you need to have a brand that acts as a big tent.

And then welcomes lots of people in.

But you do need to understand who your core purchasers are today, where they sit on the political spectrum and who your growth audiences are.

So sometimes it’s a question of get the information, know your customers so that you can navigate and be wise in the decisions you make.

And sometimes it’s, yeah, we have a political point of view and we’re going to express it strongly.

It really depends on your own brand values.

Ben Hudson 40:43

And there’s another question here for for Jen.

Jen, you discussed the growing dissatisfaction of trust of government in both countries.

Is that same consumer skepticism happening with consumer brands? Are people layering?

I think what the question is, are people layering their distrust of government? Is that layering on consumer brands?

Jennifer Birch 41:07

That’s a great question.

I don’t have the numbers in front of me and I think out of the gates people have trusted brands, but brands are for profit organizations and there was an expectation that in government an elected government that the expectation of trust was really high.

So I think the decline in trust in government and not-for-profit associate well, I shouldn’t say not-for-profit, but government and government institutions, let’s say.

The fact that dots declining is more stark than what we see with consumer brands.

Is because the expectation wasn’t as high that it can like that a Coca-Cola or a major international consumer brand. There was less of an expectation that they were there to help you, right?

Whereas if you voted for a government, you’re paying taxes.

The expectation is different.

So I think we are seeing a a bit of a an overall distrust in a lot of things.

COVID didn’t help.

And the volatility in the markets and the geopolitical situation, I think people are scared.

Right. And we’re we’re seeing a lack of trust across the board, but I think the decline has been stronger in institutions and I think it’s more important or impactful in a way because the expectation was so much higher.

What I will say is that there’s an opportunity for brands to solve public issues, right?

Which kind of comes back to our intersection between the citizen and consumer.

Brown, Shelley (TOR-FCB) 42:27

Hmm.

Jennifer Birch 42:29

Is that where people are frustrated that?

Public issues aren’t being solved by governments, and people are losing kind of the confidence that.

That governments are going to be able to solve those things. There is an opportunity for major organizations to come in and say.

You know, whether it’s public transit or whether it’s, you know, other issues that we’re having in society is that they can come in and provide solutions that governments can’t do as potentially efficiently or as effectively.

So there is an opportunity for brands to sort of capitalize, if you will.

I know it sounds a bit harsh, but on some of these gaps that we’re seeing in the way the way citizens and governments are interacting.

Brown, Shelley (TOR-FCB) 43:00

Mm hmm.

Jennifer Birch 43:06

And take on some of that ownership.

I will just say one word of caution.

If you do, you better be able to solve it because you don’t have that credibility right.

Brown, Shelley (TOR-FCB) 43:13

Yeah.

Jennifer Birch 43:15

So if you’re like, oh, we’re going to fix, you know, the traffic issue in Toronto and we’re going to come in and make this big investment.

You know, we’ve had. That was the whole Google sidewalks thing or whatever it was called.

And if you’re going to go in and do something like that, you better fixed it because you don’t have.

You know, you don’t have that kind of, but to to fall back.

On if you fail right that governments do, because at the end of the day they’re doing what they can with public funds, so it is an opportunity.

But you got to be careful and smart about it.

Brown, Shelley (TOR-FCB) 43:45

Ken, I think there’s something really interesting going on though, as the trust in public institutions declines and we’ve seen that as a long term decline across in Canada and in the US is people may be leaning into their power as a consumer more and more partly because they.

Jennifer Birch 43:57

Well.

Brown, Shelley (TOR-FCB) 44:04

Not really sure about how much impact they can have as a citizen, so I think that’s partly what’s playing out in the bicanadian movement right now.

Is people are sensing I may not be able to change the world as a citizen, but I think I can actually have an impact on the consumer side and that does create an opportunity for brands.

Jennifer Birch 44:14

Yeah.

Ben Hudson 44:27

Yeah, I think that that’s a key.

Jennifer Birch 44:28

Yeah.

Ben Hudson 44:29

I think that’s a key point in that actually comes alive in the example with with Heinz, which I thought is is a bit of A is a bit of a gold plated example of how to manage that and what what for me one underscores that is authenticity in.

Who you are as a brand, they are not trying to be somebody else.

They are not Maple washing, but they are really focusing in on what it is that it can be unique and attractive to Canadians even though they are an iconically American brand, which leads us to the last question, Shelley, we’re gonna take one more minute.

We still got a couple 100 people hanging with us. So, yeah, they’re they’re hanging out there with us.

Brown, Shelley (TOR-FCB) 44:59

Yeah, hanging on.

Jennifer Birch 45:01

This is.

Thanks everyone.

Ben Hudson 45:05

The the question really becomes, how does this environment? How does this consumer environment affect the balance between trust and loyalty versus price?

We touched on it a little bit, but is the magic.

Brown, Shelley (TOR-FCB) 45:16

Yeah.

Ben Hudson 45:19

Wand is the is, the is, the is the solution really to about authenticity and a great price.

And a great product? Or is this really? Are we gonna see a world where we’re gonna be chasing price?

Does price Trump everything at the end of the day?

Brown, Shelley (TOR-FCB) 45:33

Yeah, yeah, there will be situations where Trice will price will Trump everything.

I wish I could say that that wasn’t true, but undoubtedly that will happen and it will happen for specific consumers as well. Those people who are really constrained their household income is really constrained.

They can make a choice on one dimension only.

However, we also know, and this has been proven with very good research.

Done globally, replicated multiple times.

That the best defense against price sensitivity is a strong brand relationship and based on an emotional connection that people have, people will pay more for a brand they trust and believe in, and a brand that speaks to them and that has always been true and it continues to.

Be true today, even in this kind of environment where people are intensely worried about affordability.

So I know it’s really nice if you can just come down on one side of a debate or the other.

The fact is, both things are going to matter.

Price, though, is different from value and value will always include some kind of mental emotional connection around the brand.

So if I love this brand, I will believe better of the product and I will absolutely be willing to pay more for it.

Ben Hudson 47:02

Now, what is what is true today was true before.

Is that knowing your customer is more important than ever, and now knowing them and understanding them on a new and perhaps more complex dimension that wasn’t as important as it was even six months ago.

Well, thanks very much everybody.

Brown, Shelley (TOR-FCB) 47:18

Absolutely.

Ben Hudson 47:19

Thanks for staying with us.

We are at the end.

That was amazing, Shelley.

Thank you so much for spending the time with us, Jennifer, as always, amazing to be on screen with you.

It was great. This recording will be available.

If anybody else out there would like to connect with me, please just send me an e-mail directly to marketing@angusreid.com and we will get you everything you need.

To to have the questions answered. If you have some questions that we didn’t get to, please also feel free to e-mail us directly and we will get Jen or Shelley in touch with you when we will answer all your questions.

Thank you so much.

Everybody have a wonderful rest of your afternoon.

Thank you, Shelley.

Thank you, Jennifer again.

Brown, Shelley (TOR-FCB) 47:58

Thanks everyone.

Jennifer Birch 47:59

Thanks for your time everyone.

Thanks Sal.

Thanks, Ben and Tim. Bye.

Brown, Shelley (TOR-FCB) 48:02

Bye, Jen.

Bye, Ben.

Ben Hudson 48:04

Bye bye.

Looking for even more details?

Contact:

Jennifer Birch

Executive Vice President and Managing Director, Public Affairs North America.

jennifer.birch@angusreid.com

Recommended

Web Summit Vancouver; Brands in uncertain times.

Recently, the CEO of his namesake company, the Angus Reid Group, took centre stage at the Vancouver Web Summit with the Global CEO of FCB, Tyler Turnbull. On the docket? Insights from their groundbreaking joint Citizen Consumer Research Study. What started as a...

Angus Reid Institute’s election projections are a statistical bullseye

As votes were counted in this week’s federal election, one thing became clear: the Angus Reid Institute’s polling program delivered one of the most accurate forecasts of the campaign—not just nationally, but provincially, too. Their final projection had the Liberals...

Shachi Kurl puts Canada’s new PM on notice in the New York Times

In case you missed it, Shachi Kurl—President of the Angus Reid Institute—penned a must-read piece in The New York Times this week about Canada’s surprising federal election outcome and the challenges now facing new Prime Minister Mark Carney. You can read it here: The...

Trade Pressure, Voter Priorities, and the Power of Perception

Takeaways from our April 3 Countdown to Canada Webinar In our most recent Countdown to Canada webinar, we focused on two major themes: the political implications of Trump’s latest trade move—and what it means (and doesn’t mean) for Canada—and the rising importance of...