February 1, 2024 – The Bank of Canada’s campaign against high inflation appears to have at least decelerated the rising cost of living, but it remains to be seen if the Canadian economy will escape this inflationary period with a soft landing or a hard one – i.e. with or without a recession and significant job losses.

In the interim, new data from the non-profit Angus Reid Institute finds half of Canadians under 55 worry they will be affected by job loss in the event the economy turns. Further, a majority of the cohort most worried about job loss are more likely to have a smaller financial cushion underneath them to soften a potential blow.

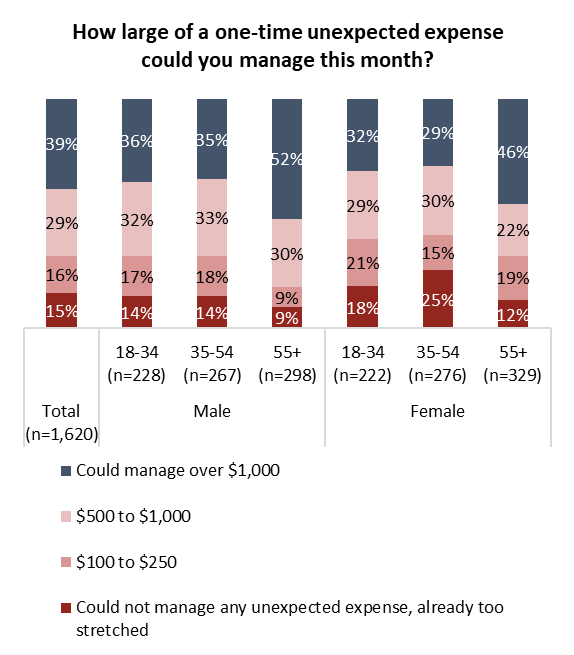

A majority of under 55s say they could not handle a sudden expense of more than $1,000 in the coming month, including one-quarter of women aged 35- to 54-years-old who say they can’t manage any unplanned bills because they are “already too stretched”.

This lack of wiggle room also affects many Canadians’ retirement savings planning. Two-in-five say they don’t contribute to a TFSA or an RRSP because they don’t have anything left to save.

As housing costs continue rise from this period of high interest rates, renters and mortgage holders feel squeezed. Majorities in those groups say they don’t have the capacity to accommodate a sudden expense of anything more than $1,000. Meanwhile, that would not be an issue for a majority of homeowners who have paid off their mortgage.

Part One: Job loss fears

Half of those under 55 worry of job loss

The fear of job loss has stuck with Canadians in recent years, despite the historic low in unemployment that followed the lifting of COVID-19 restrictions. The labour market is softening as consumer spending is already reaching lows “consistent with prior recessions,” according to one CIBC senior economist. This has resulted in restaurants, retail stores, hotels and other personal services shedding jobs, which could result in a “vicious cycle” of further dips in spending and job losses.

Half of Canadians under the age of 55 worry they could be affected by layoffs because of the economy. The last time fear of job loss was this high was during the uncertainty of the beginning of the second year of the pandemic:

Those in Quebec feel the most secure. Only Manitoba’s unemployment rate was lower than Quebec’s in December, though respondents in the prairie province express more uncertainty about their future employment. Concerns are highest in Ontario and B.C., where half worry that they or someone else in their household could lose a job because of poor economic conditions (see detailed tables).

Likely CPC voters more stressed about money, potential job loss

Previously released Angus Reid Institute data showed economic concerns were pushing many past Liberal voters to look elsewhere for relief. Those who say they would vote Conservative or NDP if an election were held today are much more likely than likely Liberal voters to worry of potential job loss in their household. CPC and NDP supporters also express elevated concerns about potentially missing a rent or mortgage payment:

Part Two: Nest eggs and savings

Canadians report thinner financial cushion than two years ago

As the economy cools, and job loss fears rise, there is also evidence many Canadians little savings to fall back on.

Pandemic restrictions kept Canadians indoors and away from places they would typically spend disposable income. This resulted in a significant savings build-up that the Bank of Canada suspected was fueling the elevated levels of inflation. These excess savings are perhaps evident in ARI data from two years ago, when half (50%) of Canadians said they could manage a one-time expense of more than $1,000. Typically, approximately two-in-five Canadians report readiness at handling such a large one-time expense.

Two years later, with high inflation eroding both Canadians’ savings and purchasing power, the ability of Canadians to handle an unexpected expense has retreated to levels consistent with those seen prior to the pandemic:

Majority of Canadians under 55 could not handle unexpected expense of more than $1,000

Older Canadians are operating with much larger financial cushions. For those under 55, a majority say they would not be able to handle a surprise expense of more than $1,000. Women aged 35 to 54 are the least likely to report being able to handle such a large sudden expense, and are the most likely to say they couldn’t handle any unexpected expense as they are “already too stretched”:

Most renters, mortgage holders could not manage sudden $1,000 expense

Housing affordability has increasingly become a factor across the country in recent years. As rent payments and mortgage payments have risen with interest rates, renters and mortgage holders are much more stressed about money than Canadians with no mortgage. Meanwhile, a majority of homeowners who have paid off their mortgage say they could handle a one-time unexpected expense of more than $1,000 with no issue. Approaching half (45%) of renters, and three-in-ten (29%) mortgage holders say anything more than $250 would break the bank for them:

Two-in-five typically don’t contribute to TFSA or RRSP

Given many Canadians lack a financial cushion, it is perhaps unsurprising that two-in-five say they don’t contribute to a TFSA or RRSP annually. Indeed, the majority reason Canadians aren’t contributing this year is because “they don’t have enough to save”. (See detailed tables). Just one-in-ten say they are contributing the maximum amount to their TFSA or RRSP in a typical year while around one-in-five are contributing less than half of their allowable limit:

Many Canadians under 44 don’t contribute to a TFSA or RRSP, despite being in the prime of their working lives as they feel the pressure from the effects of inflation and high shelter costs:

The Angus Reid Institute conducted an online survey from Jan. 16-17, 2024 among a representative randomized sample of 1,620 Canadian adults who are members of Angus Reid Forum. For comparison purposes only, a probability sample of this size would carry a margin of error of +/- 2 percentage points, 19 times out of 20. Discrepancies in or between totals are due to rounding. The survey was self-commissioned and paid for by ARI.

For detailed results by age, gender, region, education, and other demographics, click here.

For detailed results by owners and renters, click here.

To read the full report, including detailed tables and methodology, click here.

To read the questionnaires, click here.

Image – Shridhar Gupta/Unsplash

Recommended