Consumer Economic Pulse

Monitoring Uncertainty

Key Insights

Four things you should know

1

Economic pessimism persists; More believe we’re currently in a recession

2

Brand switching to save money continues to gain momentum, across categories

3

‘Buying Canadian’ remains a priority; But for some categories more than others

4

Consumers still receptive to ‘Canadian-Made’ messaging

Perspective on the economy

Current state of the economy

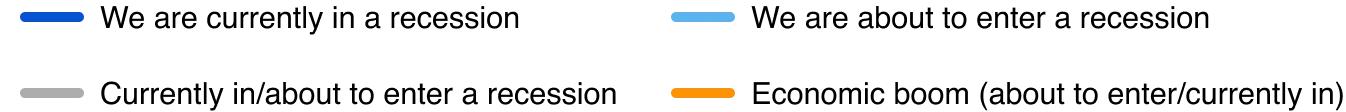

Negative sentiment about the economy persists, with 75% believing we’re in or nearing a recession. After a large spike in expectations of an imminent recession as a result of the Canada-U.S. trade dispute, the public’s views are now shifting to the idea that the country is currently in a recession.

May 26 to 28, 2025

Buying Canadian over American

Grocery staples like produce, dairy, and meat are seeing the biggest boost from the “Buy Canadian” trend, with around three-quarters of shoppers choosing local in these categories. Here the top 5:

% Selected “yes” to Buying Canadian in the Category

Digital Purchase Behaviour

While many Canadians remain selective about purchasing U.S. goods, pushback against digital or cross-border products and services has softened. Fewer are reducing/cancelling online orders from U.S. retailers or dropping American Streaming and social media platform.

%

of Canadians have not cancelled or reduced orders from US online retailers

%

of Canadians have not cancelled US – streaming service subscriptions

%

of Canadians are thinking about/ planning to cancel one or more US based social media account

Changes to Us travel plans

Fewer Canadians canceled trips to the US in May 2025. This may reflect a softening in intent to avoid travel to the US, or seasonal changes as Canadians have alrady decided to travel domestically, outside the US, or not at all.

%

of Canadians have not canceled or postponed a planned trip to the United States

Get the full Consumer Economic Pulse report here

"*" indicates required fields

About the report

Angus Reid group conducts a monthly tracker to understand Canadians’ purchasing behaviors and perceptions of the economy.

Sample

Wave 35: n= 1,514

For this wave, a nationally representative sample of n=1,518 Canadian Adults (age 18+ yrs.) who are members of the Angus Reid Forum.

The sample frame was balanced and weighted on age, gender, region and education according to the latest census data. For comparison purposes only, a probability sample of this size would yield a margin of error of +/- 2.5 percentage points at a 95% confidence level.

Field Window

Wave 35: May 26 to 28, 2025

Next Field Date: June 2025

Study

With inflation easing in 2024, many households are still adjusting to higher prices and the cost of living.

The introduction of U.S. tariffs under President Trump in 2025 has added fresh uncertainty to the economic outlook, potentially influencing the cost of imported goods and further shaping consumer sentiment. The Angus Reid Group conducts a monthly tracker to monitor Canadian’s purchasing behaviors and perceptions of the economy amid these evolving conditions.

This study has been running since May of 2022.