Consumer Economic Pulse

Monitoring Uncertainty

Key Insights

Four things you should know

1

Pessimism in the economy drops in November

2

Ease of affording household expenses rises

3

Flights to Canada hold steady, showing continued preference for staying closer to home

4

Fewer Canadians have made a financial charitable donation in 2025

Perception of Canadian Economy

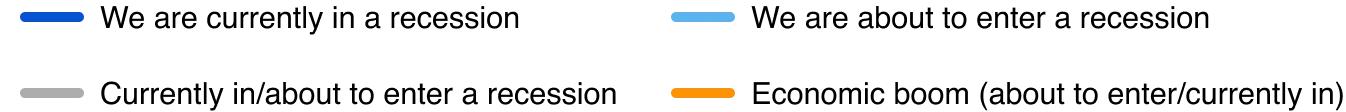

Are we in a recession?

After a significant rise in September, the number of Canadians who feel the country is in or about to enter a recession has declined significantly in November 2025. Fewer Canadians believe the economy is about to enter a recession (31%, -5pp vs. OCt), while a great number think the economy is holding steady (37%, +7pp vs. Oct).

November 17 - 19, 2025

Ability to afford household expenses over the past month

After declining through September and October, there has been an uptick in the number of Canadians able to easily afford their household expenses with enough money left over (31% +5pp vs. Oct). In addition, the number of Canadians unable to afford their household expenses is at the lowest number since July 2025.

%

of Canadians are able to easily pay for their expenses and had enough money left over for other things

%

of Canadians are able to pay for their expenses and had just a little money left over for other things

%

of Canadians are unable to pay for their expenses and took on a little additional debt each month

Flights to US and within Canada

After increasing through much of 2025, the number of Canadians who have taken a flight within Canada has held steady through November 2025. By contract, travel to the U.S. hasn’t budget since February, holding steady at 4%, highlighting that Canadians are continuing to avoid taking flights to the US as 2025 comes to an end.

Get the full Consumer Economic Pulse report here

"*" indicates required fields

About the report

Angus Reid group conducts a monthly tracker to understand Canadians’ purchasing behaviors and perceptions of the economy.

Sample

Wave 41: n= 1,516

For this wave, a nationally representative sample of n=1,516 Canadian Adults (age 18+ yrs.) who are members of the Angus Reid Forum.

The sample frame was balanced and weighted on age, gender, region and education according to the latest census data. For comparison purposes only, a probability sample of this size would yield a margin of error of +/- 2.5 percentage points at a 95% confidence level.

Field Window

Wave 41: November 17 – 19, 2025

Next Field Date: December 2025

Study

With inflation continuing to ease, many households are still adjusting to higher prices and the cost of living.

The introduction of U.S. tariffs under President Trump in 2025 has added fresh uncertainty to the economic outlook, potentially influencing the cost of imported goods and further shaping consumer sentiment. The Angus Reid Group conducts a monthly tracker to monitor Canadian’s purchasing behaviors and perceptions of the economy amid these evolving conditions.

This study has been running since May of 2022.